An offshore company in Nevis can be used for any type of legal business activity

An offshore company in Nevis is one of the safest and most reliable legal structures in the world.

This small Caribbean island offers great advantages for the incorporation of this type of companies, which are not taxed on profits and gains obtained in activities carried out outside that jurisdiction. In addition, local laws protect the personal data of the owners.

There are no restrictions on the nationality of the owner and members of the LLC. There is no minimum capital requirement, and the only prohibition is to conduct business within the island.

They are normally used as namesake companies of Delaware or other U.S. states.

Although there is a Registry of Companies in Nevis, it only lists the name of the company, the article of the organization, and the registered agent’s information, as well as the address of the local domicile. The data of the beneficial owner is kept, only by the resident agent.

Why do businessmen choose Nevis for asset protection? How is asset protection in Nevis different to other jurisdictions?

A key feature of Nevis is that court decisions taken outside the jurisdiction of Nevis are not accepted for consideration. Only decisions made in the local court are accepted. The cost of filing a lawsuit will be rather high, and needs to be paid upfront.

How to register an offshore company in Nevis

All Nevis registered companies need to have a resident agent, who is licensed as a Resident Agent. Please note that it is not possible to make an application for incorporation of a company on your own. We have extensive experience in incorporating LLCs in Nevis. We guarantee that we will have your company fully activated within a few business days.

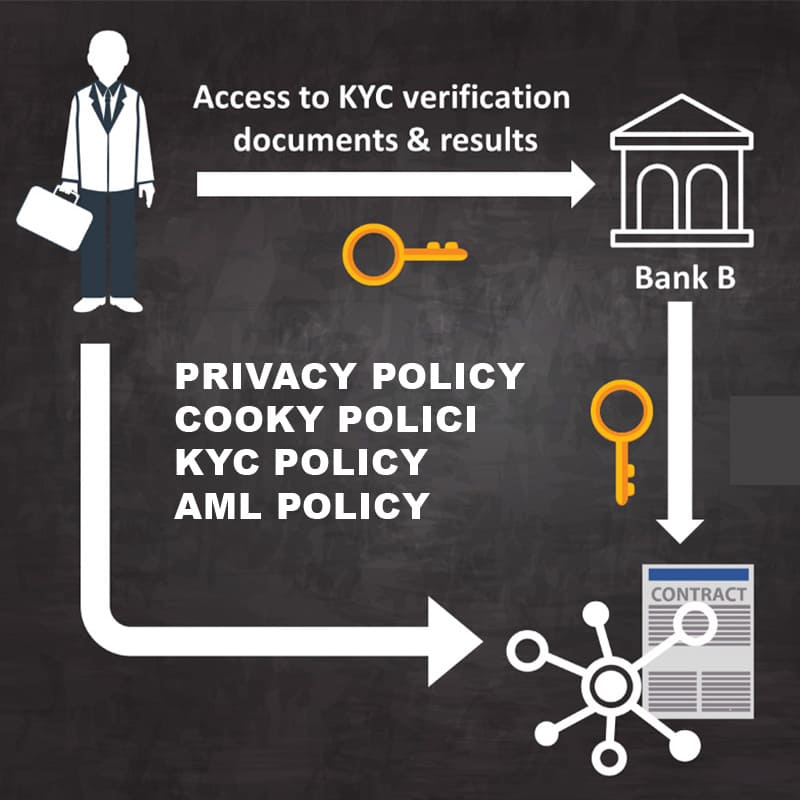

Included among the documents you will need to submit to us in your application to create the offshore company are: the electronic KYC and copy of your passport, a bank reference, as well as a utility bill, in your name and with your address. All documents must be notarized (we can do it for you). Nevis LLCs are renewed annually in January, so it is necessary to pay a fixed annual fee to the government, the resident agent and office registration.

Nevis LLCs are required to maintain accounting reports (we offer a simple accounting management program) detailing the company’s invoices and contracts. These reports are done on an annual basis and must be kept for five years at the resident agent’s office. This document, will make it possible to show, at any time, the financial situation of the company.

| Nominee director | No, Yes |

|---|---|

| Power of Attorney | No, Yes |