What is the Hague Apostille?

13/11/2022

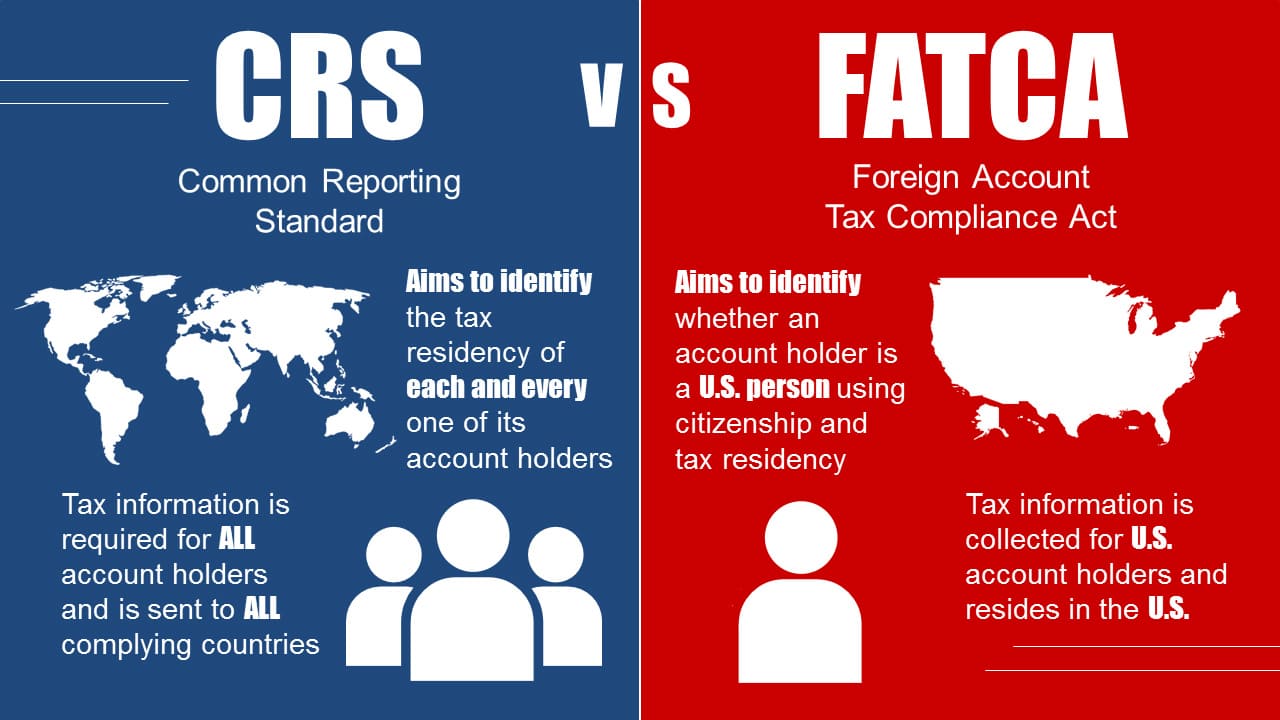

U.S. may conduct CRS information exchanges

18/11/2022

The SWIFT MT103 code is a document generated by your bank when you make an international transfer via SWIFT

The SWIFT MT103 code functions as a globally accepted payment confirmation voucher containing all the details of the transaction. Banks have the option to provide this document after making a transfer, but often refuse to provide it or charge high fees. Experts advise to be very careful with this code, because there have been many cases where hackers have forged the SWIFT MT103 to steal funds.

Who uses the SWIFT code?

SWIFT is the abbreviation for the Society for Worldwide Interbank Financial Telecommunication. This organization was created in Brussels in 1973 to enable the international banking system to communicate with each other. In this way, banks can send and receive transfers to and from different countries, through the same platform and with a computer system that validates the information linked to international payments. Currently, more than 11,000 banks in 200 countries are affiliated with SWIFT.

Each bank that uses SWIFT has a code, made up of 11 characters, divided into four groups. The first group of four letters corresponds to the bank code. The other two letters identify the country. The third group of two letters indicates the place where the bank is located and the last three digits specify the destination bank. This code is used by financial institutions to communicate with each other when making international transfers. Without this code, it would be more complicated for individuals and companies to send and receive money in their bank accounts.

What data appears in the SWIFT MT103?

This document has all the payment data, such as the date, the total amount of money sent, the currency, the sender, the receiver and the fees charged by each bank. The SWIFT MT103 works as a tracking mechanism, in case of a delay or loss of the transfer, because it shows the payment routing between banks. It also provides you with confirmation that your payment was sent.

Each bank that makes payments using the SWIFT mechanism generates an MT103 for each transaction. Access to this code is not free, as banks usually charge a minimum of $25 to send you a copy.

These are the data that appear in a SWIFT MT103

– Transaction reference number

– Bank Operation Code

– Date / Currency / Interbank settlement

– Currency / Original Ordered Quantity

– Ordering customer (Sender)

– Ordering Institution (Sender’s Bank)

– Sender’s Correspondent (Sender’s Bank)

– Correspondent of Receiver (Bank)

– Intermediary (Bank)

– Account with Institution (Beneficiary’s Bank)

– Beneficiary

– Remittance Information (Payment Reference)

– Charge Details

– Sender to Receiver Information

– Regulatory Reporting

SWIFT MT103 frauds

In April this year, SWIFT issued a statement claiming that hackers had managed to issue fraudulent payment messages in the name of SWIFT member financial institutions. The losses from these thefts were in the multi-millions.

This time, the attacks were not on citizens or companies, but focused on banks. The fraudsters penetrated the network of these institutions and modified SWIFT MT103 codes to divert payments to bank accounts they had previously opened.

The most publicized case was that of the Central Bank of Bangladesh. There, in February this year, hackers stole US$81 million after generating fake SWIFT MT103 payments from bank accounts linked to casinos in the Philippines. This was followed by attacks on the Vietnamese bank Tien Pohn, Ecuador’s Banco Austro and banks in Hong Kong, Ukraine and Russia.

SWIFT continues to assure that its messaging service is secure and that the breaches through which the hackers have entered are in the banks that were victims of the thefts.

To carry out the fraud, the hackers infiltrate the systems of the banks receiving the attack. In this way they gain access to the SWIFT network access keys. Then, through the installation of malware, they transform the SWIFT MT103, thus altering the payment control mechanisms of the bank’s operations department. In this way they manage to prevent that department from detecting the theft in time. When the alarm is finally raised, the money is no longer in the bank accounts opened by the hackers.

This new type of cybercrime is a major challenge for banks. SWIFT has asked the financial institutions that are part of its network to implement a wide range of security measures to prevent or mitigate the scope of this type of banking fraud.