What is the SWIFT MT103 code

15/11/2022

How to protect yourself from cryptocurrency scams

21/11/2022

In 2023, the U.S. may conduct CRS information exchanges on foreign financial institution accounts of foreign citizens.

Under international pressure, the U.S. could conduct CRS information exchanges. Washington now sees the need to modify the asymmetries of the bilateral agreements it has signed with dozens of countries.

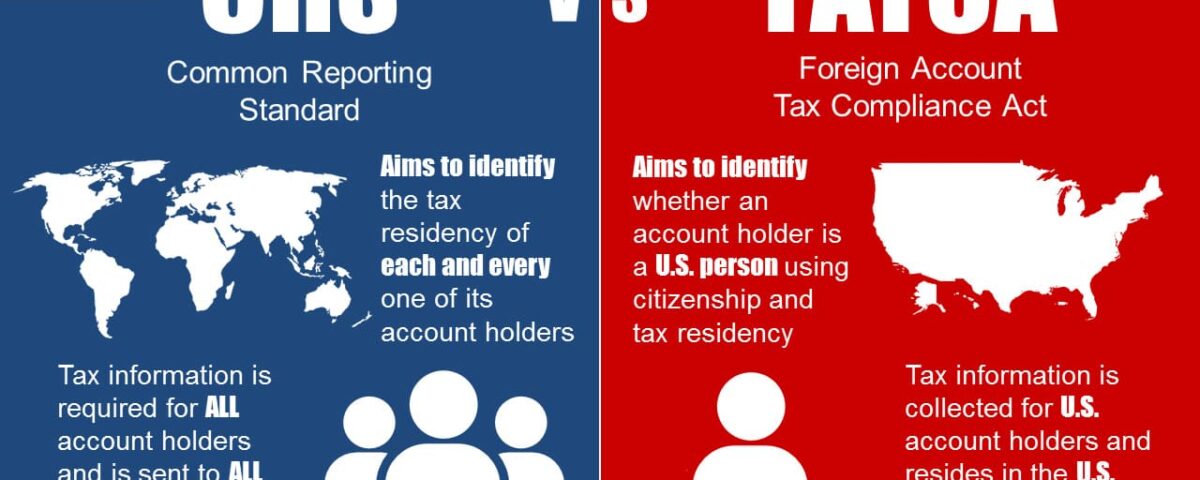

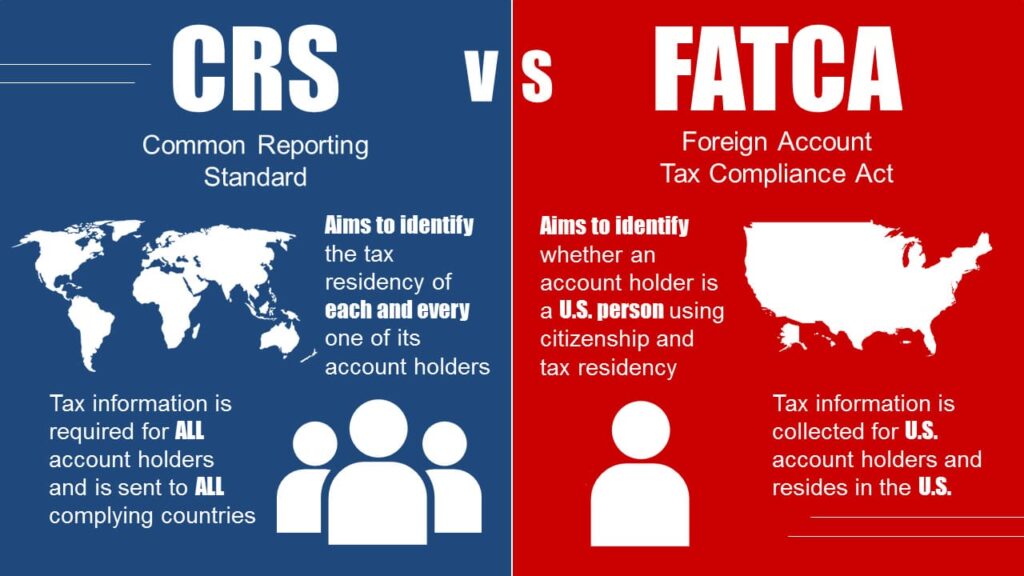

In 2010, the United States implemented the FATCA (Foreign Account Tax Compliance Act). This law sought to force financial entities around the world to report bank accounts and transactions carried out by U.S. citizens in those countries. Some time later, the Organization for Economic Cooperation and Development (OECD) created an automatic CRS information exchanges system, called the Common Reporting Standard (CRS). Today, this system is the most widely used among countries to exchange information.

Contradictorily, the United States did not want to join the CRS. There were two reasons for this refusal: the Internal Revenue Service (IRS) obtained information directly through FATCA. In addition, Washington has signed a series of bilateral information exchange treaties with 110 countries, the so-called “intergovernmental agreements” (IGA). These agreements are asymmetric, because the Treasury Department receives more information than it provides to its partners.

Washington could expand CRS information exchanges

For example, Washington obtains the balance of its citizens’ bank accounts in other countries, as well as reports on interest, dividends and other income received. However, U.S. financial institutions are prohibited from sharing the same information about citizens of countries with which they have signed the IGA.

In March of this year, a Treasury Department document was released recommending an increase in the level of information that U.S. financial institutions can share about foreign clients.

Among the possible measures to be implemented are that certain financial institutions share the balance of all financial accounts held by foreigners in U.S. entities. In addition, institutions would be required to report gross proceeds from the sale or redemption of property held in a foreign bank account in the United States.

Another possible change is that financial institutions would have to report information on passive entities and their foreign owners. Thus, an entity holding a trust account would be required to report to the IRS information about the owner of the trust.

This proposal by the Treasury Department would force U.S. cryptocurrency exchanges to report information on foreign holders of passive entities.

If these suggested measures were implemented, they would increase the demands on financial entities about their reporting to the IRS. At the same time, they would increase the opportunities for CRS information exchanges with countries with which Washington has signed agreements.