Italy is a Tax Haven for Foreign Retirees

17/02/2025

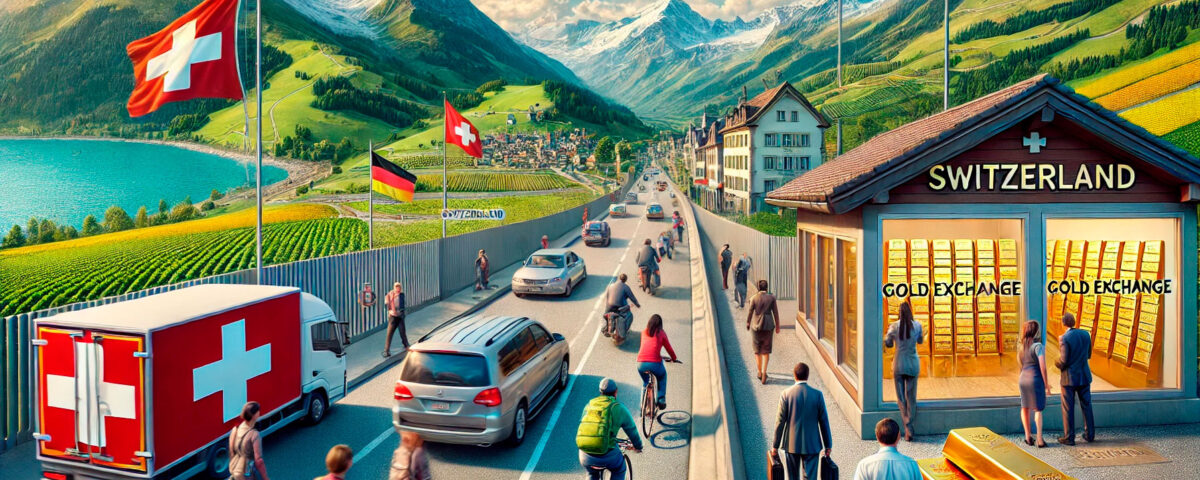

How to protect your cash by turning it into gold—discreetly—in the heart of Ticino or other regions of Switzerland

Governments are increasingly seeking to control the use of cash. Only through such control can they fully tax your income. As a result, there is a global trend toward digitalization, forcing citizens to rely on banks and credit or debit cards for virtually every transaction. In response, more and more people are considering gold as a safe haven—a time-tested way to protect capital.

Your bank accounts and funds can be frozen without notice. Credit cards, debit cards, and digital payment systems can be hacked or may fail when you need them most. Keeping a stash of cash has become essential to resist the new global financial model, protect your privacy, and be prepared for emergencies. Converting a portion of that cash into gold further enhances your financial security.

But how much cash should you keep—and where should you store it? That depends on your net worth and lifestyle. We recommend holding at least 10% of your capital in physical cash. Where and how to keep it depends on various factors. With personalized advice, we can analyze your situation and guide you, especially if you’re considering buying physical gold.

Clearly, hiding EUR 10,000 in cash is very different from hiding a million euros. The size of your cash reserve also depends on how you’re securing the rest of your wealth. Many people are also rightly concerned about currency devaluation. For that reason, they may prefer to keep a portion of their assets in gold. In this article, we outline how to convert your cash into gold.

To safely store cash or gold at home, use discreet spots like hidden compartments in furniture, false containers, or inside seasonal clothing. Avoid obvious places and divide amounts across locations. For larger sums, consider a secure home safe or a safety deposit box. Always prioritize legality, discretion, and personal security.

From Europe to Switzerland: Safeguarding Your Cash

Switzerland has long attracted those seeking stability, security, and precision. It’s a country where everything seems to function like clockwork, where order and rule-following are part of daily life, even something as simple as a crosswalk reflects this. But behind this polished image lies a discreet, opportunity-rich environment with unique flexibility when it comes to precious metals and the use of cash.

Gold remains one of the most valued tools for those looking to protect wealth or diversify investments. Thanks to its unique legal and banking system, Switzerland remains one of the world’s top destinations for buying gold—even with cash. In Switzerland, buying gold is more than an investment—it’s a philosophy.

People who choose physical gold often do so to shield themselves from economic uncertainty, reduce exposure to financial markets, or keep part of their wealth out of sight. In Switzerland, this is still possible with a level of discretion that is almost impossible to achieve elsewhere—especially for cash-based transactions.

In Ticino, especially near the Italian border, towns like Chiasso and Lugano have become hubs for Italian investors, savers, and ordinary citizens seeking alternatives to their domestic tax and regulatory systems. The same applies to border areas near France, Austria, and Germany. In these towns, gold boutiques, specialist shops, and companies offering gold purchase, storage, and brokerage services are flourishing—even for customers who pay in cash.

The process is surprisingly simple: walk into a shop, express your intent to buy investment-grade gold, and complete the transaction. For amounts up to CHF 15,000 (around €15,700), the entire process can take place without any need for identification—even when paying in cash.

For transactions above that threshold, ID is required, but personal data is not shared with foreign governments. It’s an internal registration meant solely for Swiss authorities. This allows buyers to purchase gold with cash while maintaining a high degree of privacy.

Bullion and Silence: The Quiet Side of Swiss Gold

In a world where every digital transaction is traceable and every financial move can trigger tax alerts, the ability to buy physical gold discreetly in Switzerland stands out as a rare privilege. This discretion is further supported by Switzerland’s liberal approach to cash use.

In Italy, for example, cash transactions above €5,000 are prohibited. In Switzerland, there is no legal limit on cash use. This means a customer can arrive with a substantial amount of money, make a purchase, and—if desired—store the gold in a local safety deposit box, all in complete privacy.

These deposit boxes are a key part of the system. Unlike bank accounts, they are not subject to the same automatic information exchange agreements between countries. Holding a deposit box in Switzerland does not automatically trigger a notification to your home country’s tax authorities. This ensures nearly total privacy—ideal for those storing gold or cash.

More discerning buyers, after acquiring gold bars or coins, often choose not to carry them across borders. Instead, they leave them in professional storage facilities, avoiding transportation risks and gaining time to plan future steps or reinvestments—possibly also using cash.

As a result, a well-organized ecosystem has emerged. Service providers are professional, courteous, and discreet. Many even offer personalized consultations, explaining the different types of investment gold, certification options, and the advantages of secure local storage—even for those who prefer to operate in cash.

From Cash to Bullion: A Cross-Border Journey into Gold

In most cases, gold purchases are formalized through contracts, yet everything remains within a private framework where client privacy takes priority. One factor that makes Switzerland particularly attractive is the high quality of its refined gold. Swiss refineries are considered among the best in the world in terms of purity and craftsmanship.

Swiss gold is synonymous with trust. Owning a bar stamped by a Swiss refinery is a major advantage—especially when it comes time to sell. That’s why so many European citizens and residents choose Swiss dealers: they know they’re getting a certified, traceable product that’s easy to liquidate—even if they paid in cash.

At the same time, the system intersects with a lesser known but real-world issue: border crossings. European regulations require travelers to declare amounts over €10,000 when leaving the country—even in cash.

However, the reality is that many crossing points between Switzerland and its neighbors—Italy, France, Germany, and Austria—are not permanently staffed, especially at night. Over time, this has created a grey zone, where official rules often clash with daily practice. As a result, people regularly cross borders with substantial cash amounts, later converting them into gold in Switzerland.

In Europe, restrictions on the use of cash are being considered, with the European Union (EU) evaluating a new directive that would significantly limit cash payments in an effort to reduce fraud and the shadow economy.

Starting in 2027, the European Union will implement new rules on cash transactions. According to the approved regulation, cash operations within the EU will be limited to a maximum of 10,000 euros. This measure aims to strengthen the fight against money laundering and the financing of terrorism, while also promoting greater transparency in financial transactions between individuals and businesses.

Chiasso: The Quiet Capital of Gold

No one talks openly, but the message is clear between the lines: those who act smartly and cautiously always find a way. Once purchased, gold can be resold for cash—up to CHF 50,000 per transaction.

This creates liquidity and the option to reinvest or recover your capital without facing bureaucratic hurdles. The system is designed to offer rare flexibility—especially compared to countries with stricter, more invasive rules around cash use.

This doesn’t mean illegal activity is involved. Many clients choose Switzerland simply for its discretion, safety, or convenience. Gold remains a safe haven. Amid rising inflation and geopolitical instability, allocating part of your wealth to precious metals is a prudent choice.

Additionally, thanks to the stability of the Swiss franc and the global reputation of Swiss refiners, gold purchased in Switzerland holds added value beyond its weight in grams. Of course, for those who prefer full transparency, it’s also possible to declare your position, follow all international protocols, and invest fully within the legal framework.

Still, compared to other countries, Switzerland continues to offer far more room to maneuver—both operationally and administratively. Today more than ever, the ability to buy gold with cash and store it securely is a competitive advantage for those seeking alternatives to traditional financial markets. The Swiss system—with its efficiency and discretion—continues to attract capital, buyers, and investors from across Europe.

And not just for its scenic mountains or the scent of chocolate in its old towns, but because it’s one of the few places where time seems to stand still, where the word “trust” still holds meaning, and where gold is not just a metal—but a mindset.

Switzerland, located in the heart of Europe, is a mountainous country bordered by France, Germany, Austria, Liechtenstein, and Italy. It is divided into three geographical regions: the Alps, the Central Plateau, and the Jura.