Resident Agent in Panama

24/12/2025

Neobanks 2026: the latest developments and established players in global digital banking, wallets, IBANs, complaints and real risks

Table of Contents of Neobanks 2026, wallets, IBANs, risks and complaints

Talking about neobanks in 2026 is no longer about the future, but about the immediate present of the global financial system. The banking world has changed significantly, and regulations and restrictions make it increasingly difficult to operate with low or zero taxation. In this article, we analyze neobanks in 2026, their advantages, and their limitations.

Keep in mind that many neobanks in 2026 restrict access based on the nationality of your company and the beneficial owner. The law firm Caporaso & Partners continuously monitors the banking market as well as the parallel ecosystem of wallets, neobanks, and brokers. We specialize in compliance and advisory services related to account opening and the unfreezing of restricted accounts.

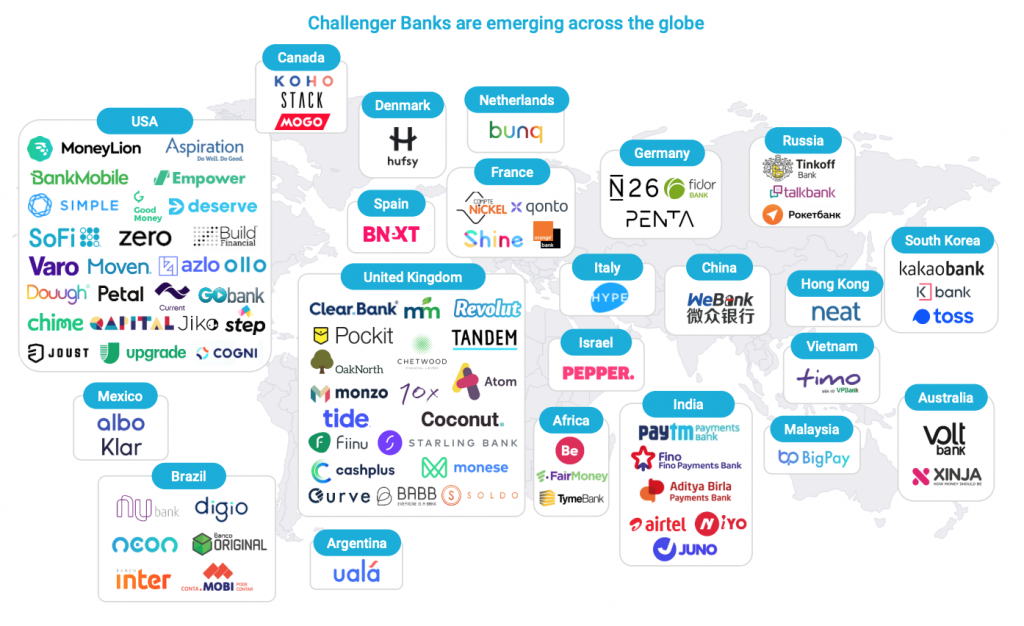

In just over a decade, traditional banking has lost its monopoly over access to money. In its place, a fragmented ecosystem has emerged, composed of digital banks, electronic money institutions, wallets, payment platforms, and hybrid solutions that operate without physical branches, rely on remote onboarding, and depend heavily on technology and automated compliance systems.

In 2026, neobanks not only compete with traditional banks, but in many cases completely replace them for millions of users. Europe has become the epicenter of the neobank sector in 2026, thanks to a regulatory framework that allows the free provision of financial services within the SEPA area. The downside is that these services often remain inaccessible to non-European residents.

Over the past few years, there has been an unprecedented proliferation of fully licensed digital banks, EMI institutions offering European IBANs, and wallets that, in practice, function as bank accounts. The result is an extremely competitive market, with clear benefits for users, but also with structural risks that recur consistently.

However, user complaints reveal a very clear pattern that repeats across almost all neobanks in 2026: preventive account freezes, automated security reviews, and customer support that, in critical moments, can be slow or impersonal. In addition, many neobanks restrict the use of VPNs and have adopted new technologies to detect a user’s internet service provider (ISP).

Neobanks use IP geolocation techniques and IP allocation databases such as WHOIS, RIPE, and ARIN, which map IP ranges to registered entities. These are combined with connection header analysis and automated web services that query such databases, providing information about the ISP and enabling providers to determine whether a user is located outside the permitted geographic area.

European neobanks and wallets

Within the European ecosystem, Revolut has established itself as one of the most visible benchmarks among neobanks in 2026. Through https://www.revolut.com/, it offers personal and business accounts, European IBANs, cards, currency exchange services, access to cryptocurrencies, and investment products. For many users, Revolut represents their first point of contact with neobanking.

A similar case is N26, available at https://n26.com/. As a fully licensed digital bank within the European Union, N26 provides IBAN-based accounts, debit cards, and financial management tools through a mobile application. It is widely used by European residents and expatriates.

However, public reviews of N26 frequently highlight complaints related to account closures following AML reviews and difficulties in reaching human customer support. These frictions are not exceptions, but rather part of the structural DNA of neobanks in 2026, where automation clearly takes precedence over discretionary decision-making.

In the Netherlands, bunq (https://www.bunq.com/) represents a more advanced version of the neobank concept, offering multiple IBANs, personal and business accounts, interest-bearing savings, and access to investments. Its focus on flexibility and customization attracts sophisticated users, but it also concentrates complaints related to strict compliance controls and customer support that does not always match the product’s complexity.

Beyond these well-known names, the real volume of European neobanks in 2026 is found in a less media-visible but widely used layer of providers. Mistertango, accessible at https://www.mistertango.com/, is a clear example. It operates as an electronic money institution and offers IBAN accounts, SEPA and SWIFT transfers, and cards, primarily for companies, startups, and international structures. Its appeal lies in fast onboarding and a cross-border focus. Nevertheless, user reports point to fund freezes during internal reviews and slow support, a particularly sensitive pattern when dealing with business accounts.

Key and established players among neobanks in 2026

Another key player is Paysera (https://www.paysera.com/), which has a strong presence in Eastern Europe and the Baltic region. Paysera offers accounts with Lithuanian IBANs, instant SEPA payments, and cards, and is widely used for online payments and e-commerce. Within the neobank ecosystem in 2026, Paysera stands out for its payment infrastructure, but recurring complaints point to extensive verification procedures and temporary account blocks when transactions are deemed unusual.

In the same segment, Wise, available at https://wise.com/, plays a significant role. Although Wise is not a traditional bank, for millions of users it functions as one of the most practical neobank solutions in 2026 for operating in multiple currencies. It offers European IBANs, multi-currency accounts, and low-cost international transfers. Reviews are mostly positive, although complaints persist regarding operational limits, repeated documentation requests, and temporary suspensions triggered by risk controls.

Europe has also seen the growth of neobanks specialized in businesses and freelancers. Qonto (https://qonto.com/) focuses on business accounts, corporate cards, and integrated accounting tools. It is particularly popular in France, Spain, Germany, and Italy. The most common criticisms relate to fees and compliance reviews rather than security issues. Bankera (https://bankera.com/) offers a similar approach, providing IBAN accounts and payment services that attract international users, albeit with stringent onboarding processes.

The European ecosystem is rounded out by wallets and hybrid platforms that, although not always defined as banks, are part of the neobank universe in 2026. Monese, Blackcatcard, Skrill, and Neteller provide digital accounts, cards, and online payment solutions and are widely used by expatriates and international users. Here, complaints typically focus on fees, geographic limitations, and automatic account blocks resulting from security controls.

Neobanks and payment systems in the United States

When shifting focus to the United States, the approach of neobanks and payment systems changes significantly. Here, the primary appeal lies in access to the US dollar, ACH payment systems, and global cards, rather than access to multiple IBANs. GrabrFi, available at https://www.grabrfi.com/en, allows users to open a USD account in a 100% digital manner from abroad. It is widely used by freelancers and remote workers. Reviews are mostly positive, although complaints do exist regarding verification timelines and the gradual activation of certain features.

Another fundamental player is Payoneer (https://www.payoneer.com/). Although it is not a traditional bank, it operates as one of the most widely used neobank-type solutions in 2026 for receiving international payments from marketplaces and global clients. This wallet allows users to receive payments only from large companies and marketplaces. Recurring complaints focus on fund holds and prolonged AML reviews.

Mercury (https://mercury.com/) completes the US landscape with a strong focus on startups and technology-driven companies. It offers USD accounts and financial management tools, but it is also known for closing accounts when a client profile does not align with its internal risk policies.

PayPal (https://paypal.com/) is the most famous, long-established, and widely recognized platform. It is often considered a nightmare by users, as it can freeze funds for six months or longer, often citing unclear or inconsistent reasons. PayPal is a global online payment service that allows users to send, receive, and manage money securely, acting as an intermediary so that buyers and sellers can transact online without sharing card details with every merchant, relying instead on an email address and password.

Purchases are covered by PayPal’s buyer protection system, which can refund transactions when something goes wrong. The system is highly favorable to buyers, even in cases of bad faith, and frequently becomes a major headache for sellers.

Neobanks in Latin America and the Caribbean

In the Americas, particularly in Latin America and the Caribbean, neobanks in 2026 take on a more hybrid form. Very few are open to non-residents, which often makes them unsuitable for digital nomads or foreign entrepreneurs. In this section, we focus on the more open platforms.

In this region, digital wallets and remittance platforms dominate, filling the gaps left by traditional banking. Coco Wallet (https://www.cocopago.app/) positions itself as a digital wallet for receiving international payments and sending funds between the Americas, Europe, and the United States. Reviews point to an inconsistent user experience, with complaints related to frequent changes in features and supported destinations.

Also operating in this region is e-KYASH (https://www.e-kyash.com/), a digital payments platform and wallet that does not function as a traditional bank. Within the context of the neobank landscape in 2026, e-KYASH occupies an intermediate position between fintech and wallet solutions. There are no widespread reports of fraud, but the lack of independent reviews and clear information about the legal entity behind the service is frequently cited as a potential risk.

Across the Americas, platforms such as Mercado Pago, Nequi, Yappy, Ualá, and Zinli are also present. In many countries, they function as genuine neobanks in 2026, offering digital accounts, cards, and instant payments. The most common complaints relate to operational limits, security-related account blocks, and highly automated customer support, particularly as transaction volumes increase.

Neobanks and crypto cards in Asia

In Asia, the concept of neobanks in 2026 blends with crypto solutions and cards issued outside the traditional banking system. RedotPay (https://www.redotpay.com/) combines a crypto wallet, a P2P marketplace, and cards accepted by merchants. Users value the platform’s flexibility, but complaints frequently point to slow customer support and unclear operational limits.

XKARD (https://www.xkard.io/) offers crypto-linked cards issued out of Hong Kong, but it does not operate as a bank nor as a direct card issuer. This structure raises recurring warnings regarding potential changes in terms and conditions and the risk of sudden account closures.

Operating on a different level is Panther Protocol (https://www.pantherprotocol.io/), which is neither a bank nor a traditional wallet, but rather a privacy-focused DeFi infrastructure. Although it is often mentioned in analyses of neobanks in 2026, the main risk highlighted by the community is the proliferation of clones and fake applications.

Bitrefill (https://www.bitrefill.com/ and https://www.bitrefill.com/card/) completes the Asian and global landscape by enabling users to spend cryptocurrencies through gift cards, eSIMs, and cards. Its overall reputation is solid, with complaints mainly concentrated on logistics and country-specific differences.

When Europe, the United States, the Americas, and Asia are considered together, the pattern of neobanks in 2026 becomes clear. The advantages are evident: fast onboarding, global reach, cost reduction, and accessibility. However, the risks are equally clear: extreme automation, preventive account freezes, reliance on algorithmic compliance, and limited human support.

In 2026, neobanks are neither a trend nor a miracle solution. They are powerful tools that require understanding, planning, and a realistic assessment of risk. The law firm Caporaso & Partners in Panama offers alternative solutions for high-value funds management and access to offshore banks across multiple jurisdictions.

Neobanks in 2026 form the backbone of the global digital financial system, but they are often best suited to integrating traditional payment collection systems. Choosing the right solution does not depend on promises of simplicity, but on understanding what type of entity is being used, under which regulatory framework it operates, and what level of friction each user is willing to accept in an increasingly automated financial world.