Beware of SWIFT Mt103/23 Scams

15/03/2023

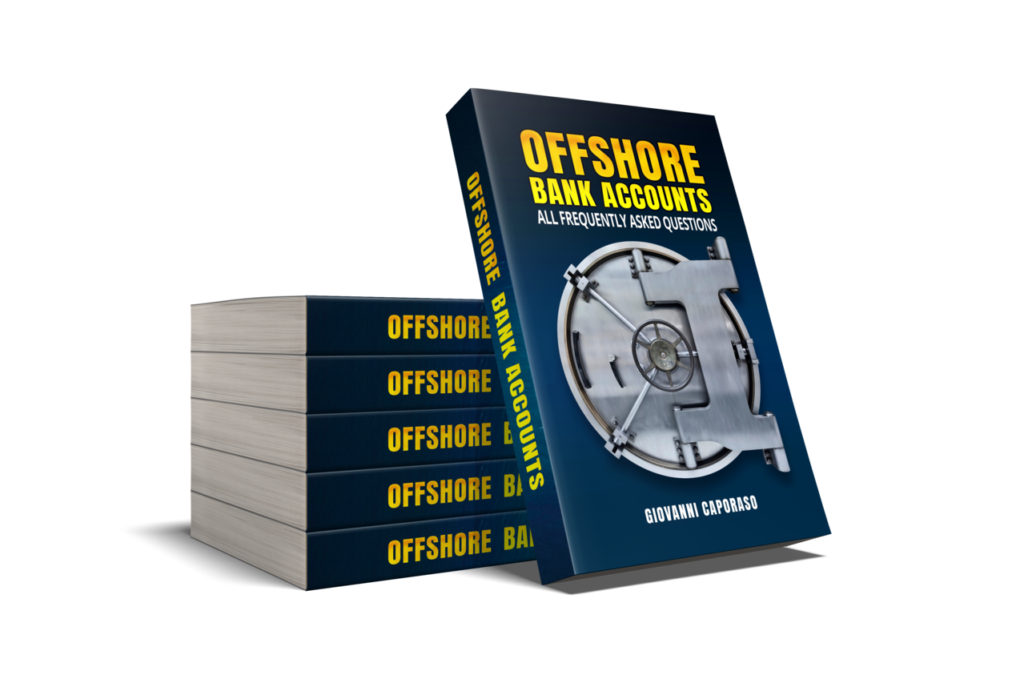

OPM Corporation, a leading offshore legal services company, has released a new guide on Offshore Bank Accounts: All the Frequently Asked Questions, which addresses all questions related to offshore bank accounts. The guide aims to provide detailed and accurate information on how offshore bank accounts work, as well as the associated risks and benefits.

According to the guide on offshore bank accounts, offshore banks hold deposits of around $7 trillion, which is equivalent to 8% of the world’s GDP. Although offshore bank accounts have been controversial in the past due to their association with tax evasion, OPM Corporation’s guide addresses all questions that individuals and businesses may have.

The text begins with a clear definition of what an offshore bank account is, followed by a discussion of the available options for those who wish to open an anonymous bank account. The guide also explains why some people may choose to have an offshore bank account, including privacy and asset protection.

OPM Corporation’s guide also answers the crucial question of whether having an offshore bank account is legal. According to the guide, having an offshore bank account is not illegal, but individuals and businesses must comply with applicable tax and financial laws in their home country.

The author also addresses a series of practical questions, such as where the main offshore banking centers are located, what the best option for an offshore bank account is, and how to open an offshore bank account. The guide also includes a detailed discussion of the requirements for opening a personal offshore bank account and the costs associated with maintaining an offshore bank account.

In addition, OPM Corporation’s guide on offshore bank accounts, discusses the topic of taxes associated with offshore bank accounts, how to access your money in an offshore bank account, and whether a minimum balance is required to have an offshore bank account. Security issues are also discussed, such as how to ensure the safety of your money in an offshore bank account and what risks are associated with having an offshore bank account.

The brochure also delves into legal and regulatory issues, such as automatic exchange of information and the blacklist of tax havens. It also discusses what happens if an offshore bank account is not declared and what measures exist to prevent money laundering in offshore banking.

Finally, OPM Corporation’s guide answers the question of how to repatriate funds from an offshore bank and how to receive a SWIFT MT 103/23.

In summary, OPM Corporation’s new guide provides valuable and detailed information on all frequently asked questions related to offshore bank accounts. If you are considering opening an offshore bank account or simply want to learn more about the topic, this guide is an excellent source of reliable and accurate information.